Content

For example, if you calculate cash flow for 2019, make sure you use 2018 and 2019 balance sheets. Changes in cash from investing are usually considered cash-out items because cash is used to buy new equipment, buildings, or short-term assets such as marketable securities. But when a company divests an asset, the transaction is considered cash-in for calculating cash from investing. Therefore, buying or selling highly liquid debt and equity securities is not included in the investment activity category but is included in operating activities.

- FREE INVESTMENT BANKING COURSELearn the foundation of Investment banking, financial modeling, valuations and more.

- Investing activities involve transactions that use cash in the long term.

- Analysts look to capital expenditure figures as an essential input in stock valuation.

- You can use your company’s cash flow statement to learn a lot about the business.

Paying the suppliers more than the related expenses reported on the income statement had a negative or unfavorable effect on the company’s cash balance. If the balance in prepaid expenses had increased during the year, it means the company had paid out more cash than the amount reported as expense on the income statement. Therefore, investing activities the increase in this current asset is subtracted from the amount of net income. In other words, increasing the balance in prepaid expense was not good for the company’s cash balance. Since this amount is in parentheses, it communicates that the company collected less cash than the amount of sales reported on the income statement.

What Are Investing Activities? How to Report Investment Activities on the Cash Flow Statement

Statements of cash flow give an indication of what needs to be rectified and realigned. It helps assess the company’s investment strategy’s cash negative/ positive position. It indicates any need for additional funding or if excess cash can be used in other activities, such as debt repayment.

The decrease in receivables is positive, favorable, and good for the company’s cash balance. Based on the cash flow statement, you can see how much cash different types of activities generate, then make business decisions based on your analysis of financial statements. If a company is reporting consolidated financial statements, the preceding line items will aggregate the investing activities of all subsidiaries included in the consolidated results.

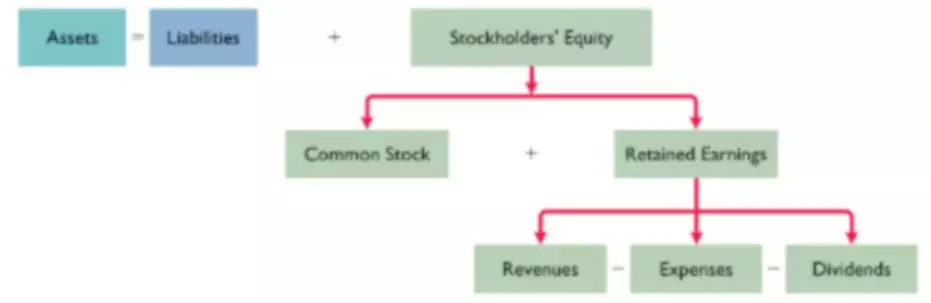

Adjustments to Convert the Net Income Amount to the Cash Amount

As we discussed earlier, we put the purchase price of the truck as an asset on our balance sheet, then we take small amounts as an expense each month as depreciation to spread the expense out over time. If we purchased the truck for $25,000, from a cash perspective, we had a $25,000 outflow, right? So even though the truck goes to the balance sheet, we need to note the entire purchase price on our cash flow statement.

Financing activities detail cash flow from both debt and equity financing. Cash and cash equivalents are consolidated into a single line item on a company’s balance sheet. It reports the value of a business’s assets that are currently cash or can be converted into cash within a short period of time, commonly 90 days. Cash and cash equivalents include currency, petty cash, bank accounts, and other highly liquid, short-term investments. Examples of cash equivalents include commercial paper, Treasury bills, and short-term government bonds with a maturity of three months or less. Using the indirect method, actual cash inflows and outflows do not have to be known.

How Do You Use Cash Flow from Investing Activities?

IAS 7 Statement of Cash Flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. The second way to prepare the operating section of the statement of cash flows is called the indirect method. Calculating cash flow from investing activities is completed automatically if you’re using accounting software to manage and record your financial activities. If you’re not, you’ll need to add up the proceeds from the sales of long-term assets or the money received from the sale of stocks, bonds, or other marketable securities. Consider a hypothetical example of Google’s net annual cash flow from investing activities.

How do you calculate investing activities?

Calculating the cash flow from investing activities is simple. Add up any money received from the sale of assets, paying back loans or the sale of stocks and bonds. Subtract money paid out to buy assets, make loans or buy stocks and bonds. The total is the figure that gets reported on your cash flow statement.